Homelend is a decentralized platform enabling the next generation of homebuyer mortgage financing. Homelend creates an interface for direct interaction between borrowers, lenders and other parties involved in the mortgage value chain. By doing so, it enables mortgage crowdfunding using a peer-to-peer model with the security, transparency and automation provided by distributed ledger technology ( DLT ) and smart contracts

Today's Mortgage Lending Industry

- Mortgage Loans Are at the Core of Society

Having a home is one of the basic human needs - a need most people are only able to afford by taking out a mortgage loan from the bank. In the U.S. alone, more than 8 million mortgage loans are granted every year

- An Archaic $31 Trillion Industry Yearning for Disruption

The U.S. mortgage market is valued at $14 trillion, and the global market is expected to reach $31 trillion by the end of 2018. Yet, despite how central this market is both socially and economically, the traditional mortgage lending system remains incredibly primitive

The system relies on lengthy and complex paper-based processes involving various intermediaries—processes that are laden with inefficiencies and overhead costs for both borrowers and lenders. Moreover, mortgage loans are largely unattainable for the new generation of young borrowers, excluding millions of creditworthy individuals from obtaining home loans due to outdated assessment criteria

Homelend Mortgage Crowdfunding Platform

We Are Developing a Decentralized, Peer-To-Peer Mortgage Lending Platform Serving Two Purposes :

- Modernizing the age-old mortgage lending system in order to make it efficient, cost-effective and customercentric

- Expanding home ownership opportunities for a new generation of borrowers, meeting their distinct lifestyle and needs

Benefits The Homelend Advantage

- From manual length to Efficient and Efficient

By embedding predefined business logic into smart contracts, digitizing documentation and eliminating unnecessary processes, Homelend will automatically perform an end-to-end origination process, cutting it from 50 days to less than 20

- From Ambigu Clunky to Transparent & User-Friendly

Homelend aims to create a loan process that is not only smart, but also simple and fair. This will allow borrowers to be able to easily apply for loans, track the status of their application at any time and interact directly with mortgage lenders

- From Intermediation Fee to Cost - Effective and Middleman-Free

The firmness, security and transparency provided by DLT makes it possible to record transactions, including loans, without the bank acting as an intermediary. This will reduce costs for borrowers and lenders, while minimizing the distance between them.

- From Vulnerable Can not Trusted and Trusted Safe

Centralized and paper-based processes are the key factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts allow Homelend to provide a platform for people to transact large sums of money in a trustworthy, transparent, and secure way

How does it work

By utilizing distributed ledger ( DLT ) and smart contracting technologies, Homelend brings together individual borrowers and lenders on an end-to-end platform that simplifies and automates the entire process of mortgage origination

Business model

Homelines are being developed as a blockchain solution that will significantly increase the likelihood of housing finance for many individuals and families. Our value proposition for a sensitive social and progressive approach anchored in P2P aims to use technology to benefit society. However, Homelend is also based on a healthy and profitable business model, which is aware of reaching underserved market addresses. On the one hand, Homelend creates investment opportunities for many individuals, with solutions that unite traditional industries as real estate, with innovative technologies such as blockchain. On the other hand, it may be for many people (who due to various circumstances, including the current limitations in traditional credit risk models do not have a solid credit score

How to Homelend platform

Homelend connects borrowers and lenders in a unique way, controlled by smart contracts, without involving intermediaries. The borrower will apply for a mortgage loan through the Homelend platform. This app will be checked and approved ( or not ) with the help of machine learning and artificial intelligence technology. Then, each lender will be able to finance the pre-approved loan by buying "Iris" from them. All processes will be controlled by the intelligent protocol of the contract, not by humans. In the Homelend platform, information gathering is done by "all digital". Even data in paper-based documents should be transferred to a digital book-based storage storage technology. This data is provided by the user and checked through a professional verification provider.

Financial flows in Homelend, the flow of financial resources from lenders to borrowers ( and, finally, to sellers ) run purely by smart contracts. There are financial services, controls or decision-making by Homelend Once the buyer receives pre-approval from the system, regarding a particular property, a "registered" mortgage loan on the Homelend platform. Thus, the borrower has made a certain face, and the amount of credit is determined

Crowdfunding Homelend Mortgage Platform

We Developed a Decentralized Mortgage Lending Platform, Peer-To-Peer Serves Two Purposes :

- Modernize old age mortgage lending system to be efficient, cost-effective, and customercentric.

- Expand home ownership opportunities for new generation of borrowers, meet their different lifestyles and needs.

THE HOMELEND TOKEN ( HMD )

The HMD token is the fuel that drives Homer's peer-to-peer lending platform. Its main functionality is to provide access to the Homelend platform

This utility token also plays an instrumental role in enabling a fast, seamless, easy-to-use, easy-to-use workflow

All tokens can be converted to and from HMD

Schedule

- Pre-Sales : March 1, 2018

- Crowdsale : Closure

- TBD : TBD

Specification

- The symbol : HMD

- Total inventories : 250 million +

- Standard : ERC-20

- Nominal : 1 ETH = HMD 1,600

- Currency : BTC, ETH, USD

- Soft - cap : US $ 5 million

- Hard - cap : US $ 30 million

Use of Results

- 25% General Administration

- 40% development

- 35% of society and building marketing

Allocation of Token

- 28% of pre-sales

- 36% of general sales

- 20% Reserve fund

- 8% of advisors and Bounty Program

- 8% Founder

Bonus ( ETH / HMD )

- Week 1 : 20%

- Week 2 : 15%

- Week 3 : 10%

- Week 4 and After : 0%

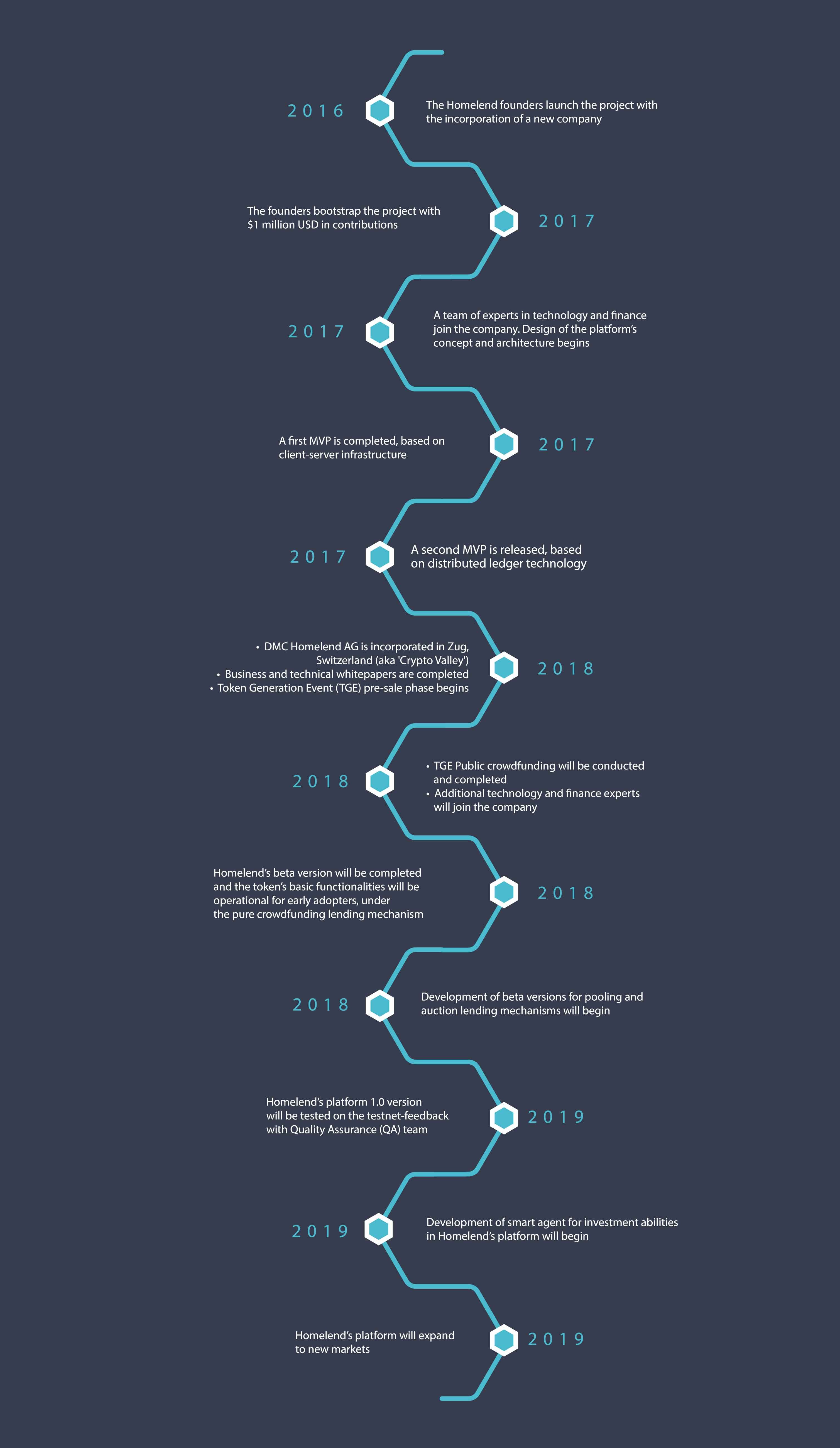

Roadmap

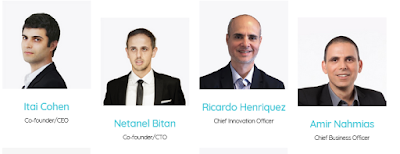

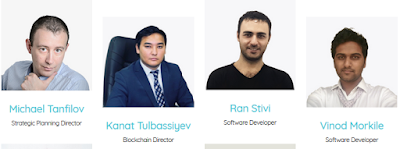

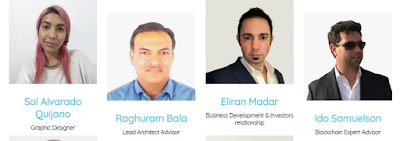

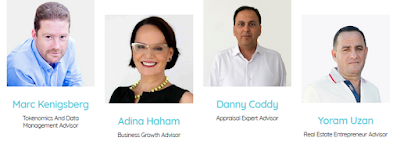

Team And Advisers

For detailed information about our ICO you can also visit our website address below from me and thank you :

- Website : https://homelend.io/

- WHITEPAPER : https://homelend.io/files/Whitepaper.pdf

- Twitter : https://twitter.com/homelendhmd

- Facebook : https://www.facebook.com/HMDHomelend/

- TELEGRAM : https://t.me/HomelendPlatform/

- MEDIUM : https://medium.com/homelendblog

- LINKEDIN : https://www.linkedin.com/company/18236177/

- Reddit : https://www.reddit.com/r/Homelend/

- ANN THREAD : https://bitcointalk.org/index.php?topic=3407541

BitcoinTalk : https://bitcointalk.org/index.php?action=profile;u=1422028

ETH : 0x4A872D9F27CC3Ddafc00714d6100aB6fAb6613ca

Tidak ada komentar:

Posting Komentar